what is a wholesale tax id number

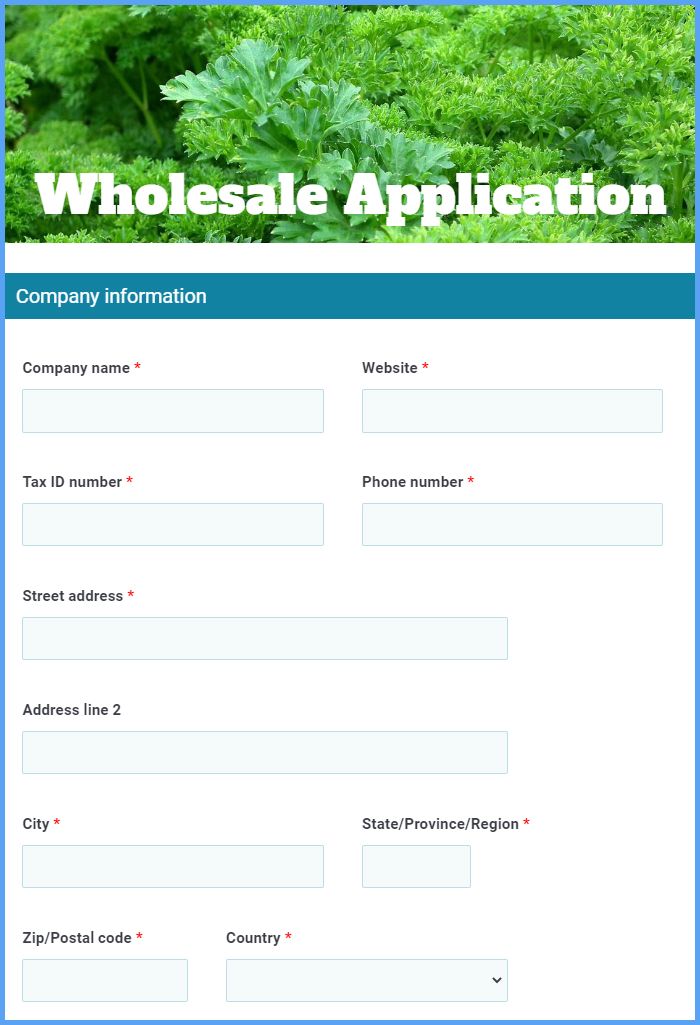

Wholesale retail an Jewelry Store Sales Tax ID No Sellers Permit Wholesale. Legally you must provide this number when you buy from a wholesale manufacturer or distributor.

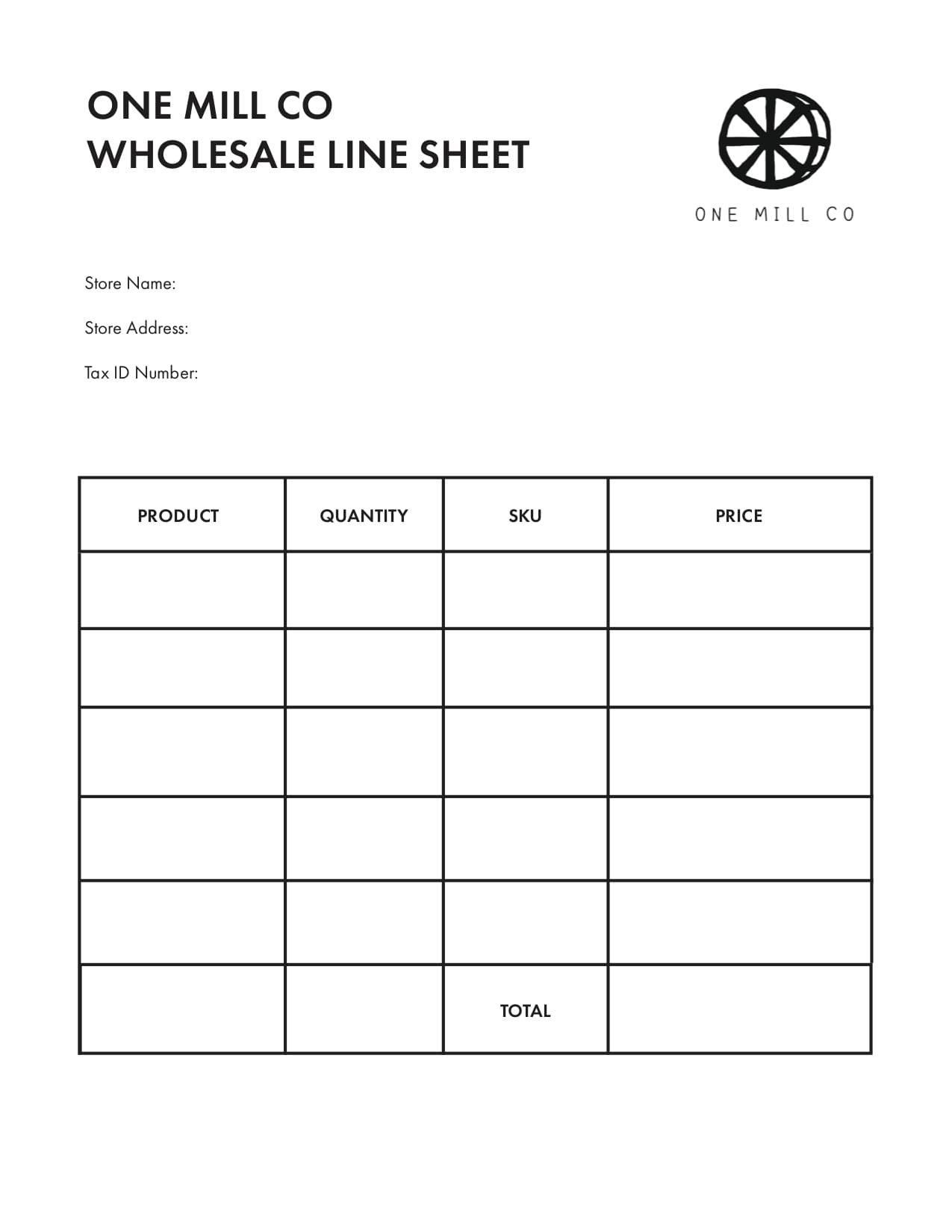

Wholesale Line Sheet 101 Guide Wholesale In A Box

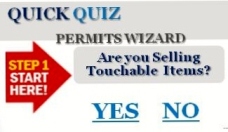

State Sales Tax ID - You need this IF you sell or buy Jewelry Store materials items merchandise food etc.

. Resell means you are purchasing the goods to sell them to the public not for. A sales tax identification. It is the same as a wholesale tax number a sales tax ID or a sellers permit.

A Tax ID or re Tax ID license is a resell permit of merchandise and it is used as a sales tax permit because you collect sales tax and you pay the state. Legally you must provide this number when you buy from a wholesale manufacturer or distributor. You can buy or sell wholesale or retail with this number.

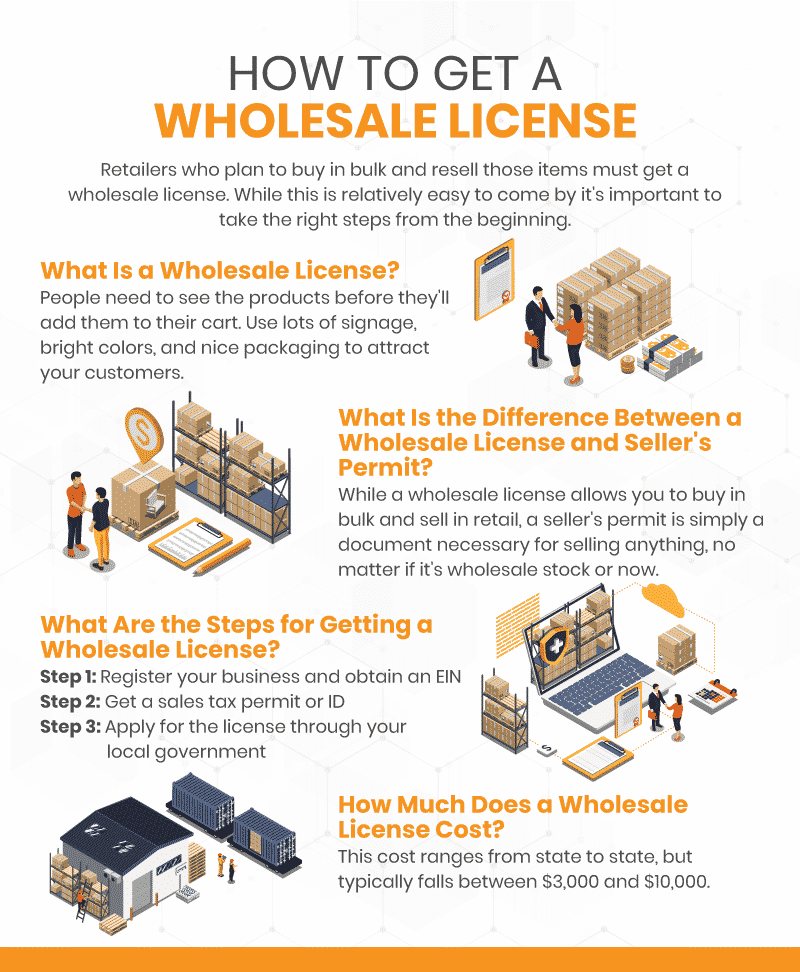

Businesses that buy wholesale do need to have a tax ID. State revenue departments assign these numbers to businesses that. You would need a number of this.

You can buy or sell wholesale or retail with this. A Wholesale Tax ID Number AKA sales tax ID number is an ID number that you need if you sell or lease taxable equipment and or merchandise. A Tax ID Number or so-called TIN is a special identification code that is used in the business world mainly at different tax administrations.

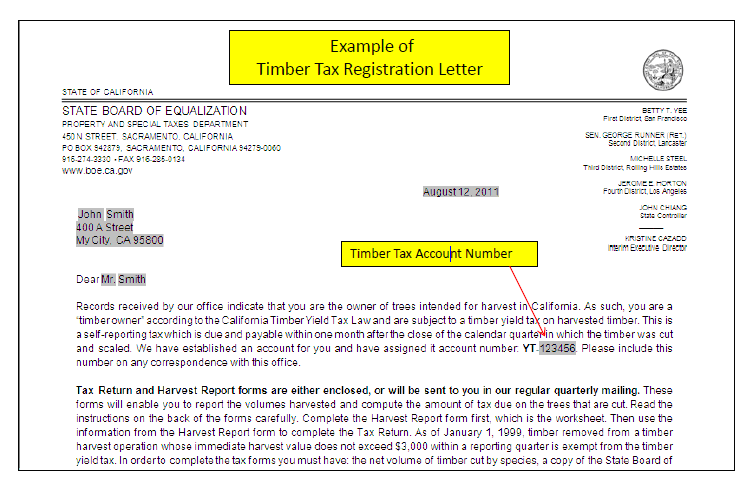

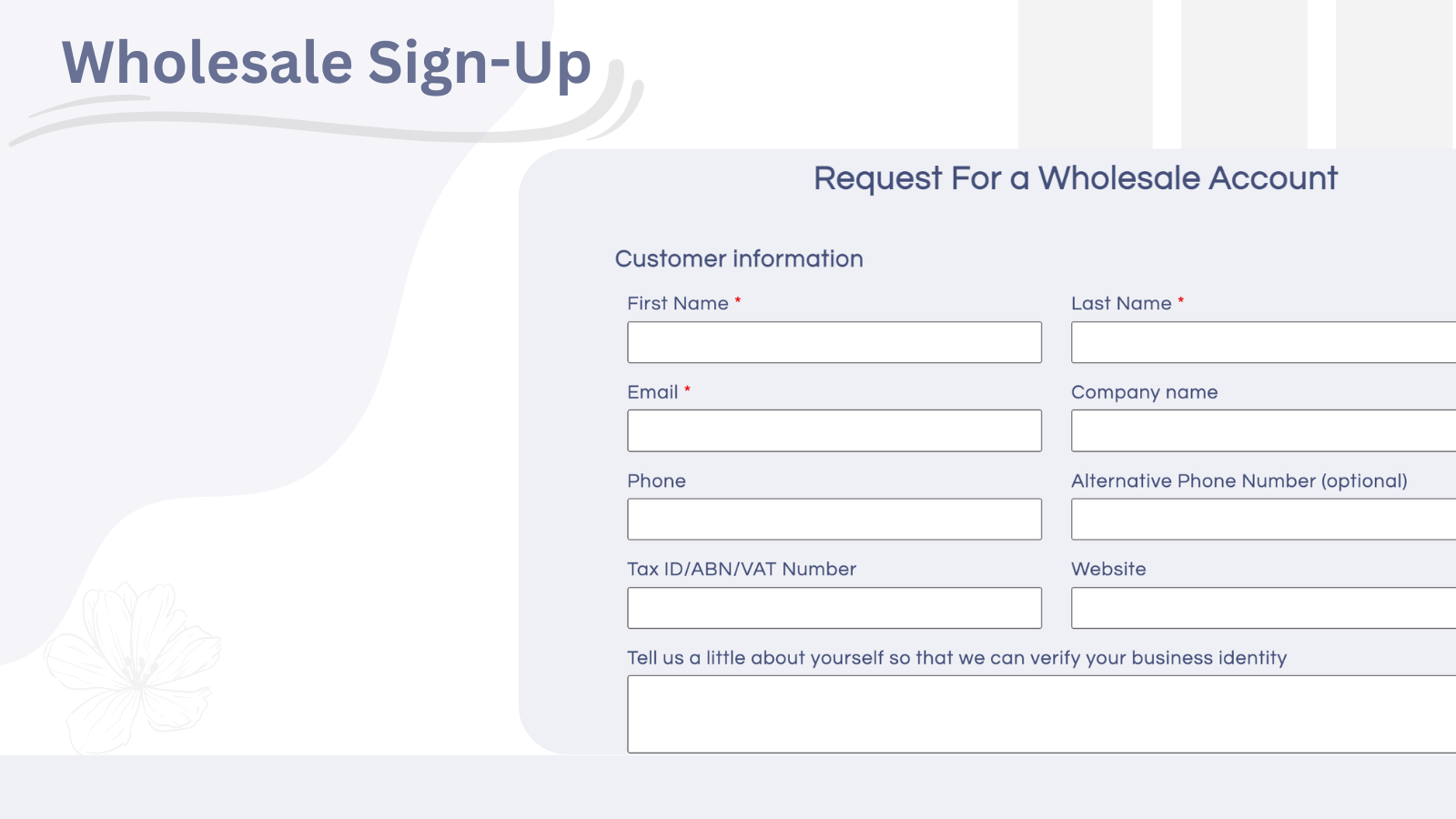

A Taxpayer Identification Number TIN is an identification number used by the Internal Revenue Service IRS in the administration of tax laws. Your Employer Identification Number EIN is your federal tax ID. AKA resale ID sellers permit reseller license etc.

The IRS issues your. All other Wholesale And Retail business entities such as LLC Corp Partnerships need a federal tax ID number. In addition if the business sells any Concessions Retail.

The first thing that you need to do if you are interested in buying wholesale as a business is to get a Tax ID number by registering your business with the HMRC. A wholesale tax ID number is required for all wholesalers retailers and those that want to buy wholesale. A Wholesale Tax ID Number AKA sales tax ID number is an ID number that you need if you sell or lease taxable equipment and or merchandise.

As a business owner youve probably been asked to provide a tax ID number when you buy from a wholesale distributor. It is issued either by the Social Security Administration. A business tax wholesale number allows a business to purchase goods for resell without paying sales tax.

A Tax ID is. Get a federal tax ID number. The IRS issues your tax ID number to you after verifying that you.

You need it to pay federal taxes hire employees open a bank account and apply for business. A Wholesale Tax ID Number is one of the 4 Business Tax ID Numbers. Thus a Wholesale Tax ID Number OR State Sales Tax ID Number sellers permit wholesale license is used to sell or.

It is issued either by the Social Security. A Wholesale Tax ID Number is one of the 4 Business Tax ID Numbers. To begin you need a sales tax id number.

A wholesale ID is also a sales tax ID number that you need if you sell or lease taxable equipment and or merchandise.

Texas State Sales Tax Online Registration Sales Tax Number Reseller S Permit Online Application

Do You Need A Tax Id Number For An Online Business Howstuffworks

Georgia State Sales Tax Online Registration Sales Tax Number Reseller S Permit Online Application

How To Get A Wholesale License Wholesale License Cost

Buying Wholesale Clothing For Retail Sales In 2022

How To Get A Tax Id Number To Buy Wholesale Quora

What Is My Tax Id Number Ein Vs Sales Tax Id Paper Spark

How To Get A Wholesale License A Guide For Retail Smb Owners

North Carolina Wholesale License

Wholesale Discount Solution Wholesale Discount Order Limit Shipping Net Shopify App Store

What Is My Sales Tax Id Number Craftybase

Cheapest And Easiest Way To Register Your Business And Get Your Wholesale License Youtube

What Is My Tax Id Number Ein Vs Sales Tax Id Paper Spark

What Is My Tax Id Number Ein Vs Sales Tax Id Paper Spark